The explosion of Shopify Plus brands over the last 5 years has been incredible. From the homegrown brands that outgrew Shopify’s standard plans to the Mid-Market and Enterprise brands like Red Bull, Coty, Gillette, Glossier, and Supreme that now trust the platform, has opened up a new growth area for most Shopify apps. You no longer need to capture tens to hundreds of thousands of Shopify apps to build a really meaningful business in the Shopify ecosystem.

As this growth has happened, there has been a Cambrian explosion of Shopify apps in the space. and as more companies have raised more money, there seem to be tens of providers in every space that do similar things.

While each app lists the number of brands they work with on their website, our goal is to provide you with more data and comparison information to get a better understanding of the ecosystem.

One interesting trend to call out before starting the analysis is how many areas Shopify has an app that’s leading a category. In Reviews and Influencer/Affiliate Management, Shopify’s native app has the most adoption in the space, in Support, it’s #4. Shopify’s narrative is their native products focus on their down-market customer base, but as Plus grows, it appears the focus of those apps is growing as well.

Methodology

This report was built by extracting the Apps and Technologies used by eCommerce stores on a Shopify Plus plan. Each individual technology was counted on a store level and is represented as a percentage of the total installs across all Shopify Plus stores. Percentages represent market share (# of Plus stores using technology/Total number of Plus stores)

This data does not indicate the entire Shopify ecosystem and is solely focused on App/Tech market penetration among Shopify Plus stores. We’ve included Shopify’s Native apps with an * to indicate that it isn’t a true 3rd party app. We’ve removed Advertising Pixels from the core analysis as this analysis focuses on 3rd party apps within the Shopify ecosystem.

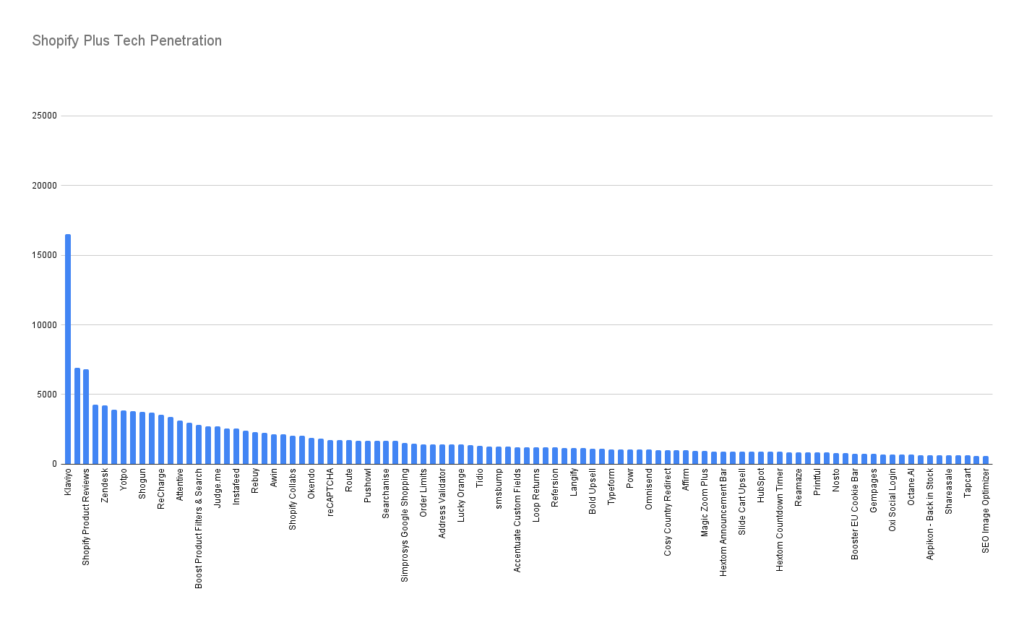

Top 100 Most Installed Shopify Plus Apps & Technologies

| App Name | Total Installs | % of Shopify Plus Stores |

|---|---|---|

| Klaviyo | 16,056 | 59% |

| Hotjar | 6,900 | 25% |

| Shopify Reviews* | 6,818 | 25% |

| Google Optimize | 4,933 | 18% |

| Klarna | 4,279 | 15% |

| Zendesk | 4,203 | 15% |

| Geolocation* | 3,907 | 15% |

| Yotpo | 3,864 | 14% |

| Gorgias | 3,811 | 14% |

| Shogun | 3,749 | 13% |

| Afterpay | 3,708 | 13% |

| Recharge | 3,566 | 13% |

| Back in Stock | 3,407 | 13% |

| Attentive | 3,135 | 11% |

| Stamped | 3,000 | 11% |

| Boost Product Filter & Search | 2,838 | 11% |

| Mailchimp | 2,696 | 10% |

| Judge.me | 2,692 | 10% |

| Trustpilot | 2,550 | 10% |

| Instafeed | 2,542 | 10% |

| Customer Privacy | 2,412 | 9% |

| Rebuy | 2,280 | 9% |

| Yotpo Loyalty (SwellRewards) | 2,226 | 8% |

| Awin | 2,173 | 8% |

| Swym (Back in Stock Alerts) | 2,165 | 8% |

| Shopify Collabs | 2069 | 8% |

| Smile.io | 2,052 | 7% |

| Okendo | 11,913 | 7% |

| accessiBe | 1,823 | 7% |

| reCAPTCHA | 1,732 | 6% |

| Triplewhale | 1,745 | 7% |

| Route | 1,716 | 6% |

| Elevar | 1,700 | 7% |

| Pushowl | 1,696 | 7% |

| Pagefly | 1,685 | 7% |

| Searchanise | 1,659 | 6% |

| Smart Search Bars and Filters | 1,659 | 6% |

| Simprosys Google Shopping Feed | 1,521 | 6% |

| Loyaltylion | 1,476 | 5% |

| Order Limits | 1,447 | 6% |

| Privy | 1,440 | 5% |

| Adress Validator | 1,417 | 5% |

| Easy Redirects | 1,416 | 5% |

| Lucky Orange | 1,410 | 5% |

| Loox | 1,381 | 5% |

| One Trust Cookie Consent | 1,359 | 5% |

| Tidio | 1,329 | 5% |

| Justuno | 1,273 | 5% |

| Yotpo SMS (SMSBump) | 1,266 | 5% |

| Free Gifts | 1,263 | 5% |

| Accentuate Custom Fields | 1,235 | 5% |

| GRIN | 1,232 | 5% |

| Loop Returns | 1,227 | 5% |

| Shoppable Instagram & UGC | 1,214 | 5% |

| Refersion | 1,210 | 4% |

| Aftership | 1,184 | 4% |

| Langify | 1,150 | 4% |

| Stockist | 1,147 | 4% |

| Bold Upsell | 1,120 | 4% |

| Sezzle | 1,090 | 4% |

| Typeform | 1,079 | 4% |

| Rise.AI | 1,078 | 4% |

| Powr | 1,069 | 4% |

| Weglot | 1,062 | 4% |

| Omnisend | 1,061 | 4% |

| Infinite Options | 1,005 | 4% |

| Cozy Country Redirect | 996 | 4% |

| Frequently Bought Together | 988 | 4% |

| Affirm | 987 | 4% |

| Easy Gift | 972 | 4% |

| Magic Zoom Plus | 968 | 4% |

| Signifyd | 920 | 3% |

| Hextom Announcement Bar | 916 | 4% |

| Kiwi Size Chart | 914 | 4% |

| Slide Cart Upsell 905 (4%) | Slide Cart Upsell 905 | 4% |

| Hulk Code | 897 | 3% |

| Hubspot | 982 | 3% |

| GOAFFPRO | 888 | 3% |

| Hextom Countdown Timer | 886 | 3% |

| Powerful Contact Form Builder | 855 | 3% |

| Reamaze | 851 | 3% |

| Shopify Inbox* | 851 | 3% |

| Printful | 841 | 3% |

| Algolia | 839 | 3% |

| Nosto | 813 | 3% |

| UpPromote | 786 | 3% |

| Booster EU Cookie Bar | 765 | 3% |

| Dotdigital | 759 | 3% |

| Gempages | 721 | 3% |

| Fullstory | 705 | 3% |

| Oxi Social Login | 691 | 2% |

| Maestrooo Section Feed | 674 | 2% |

| Octane.AI | 672 | 2% |

| VWO | 669 | 2% |

| Appikon Back in stock | 653 | 2% |

| Postcript | 648 | 2% |

| Shareasale | 641 | 2% |

| Reviews.io | 639 | 2% |

| Tapcart | 634 | 2% |

| Wishlist King | 617 | 2% |

| SEO Image Optimizer | 616 | 2% |

* Indicates that this is a native app built by the Shopify team.

Interesting Trends

-

- So much growth left in the space.

-

- No one category is 100% penetrated across all of the providers.

-

- Outside of Email, there’s no category that’s owned by a player with 50%+ Market share

-

- Capturing 5% market share puts an app in the Top 50 Plus apps. Capturing 15% puts an app in the Top 5.

-

- Despite Back in Stock being a standard feature in most ESPs 3.4k brands still use a stand-alone app for it.

-

- Google sunsetting Optimize presents a huge opportunity for someone to step in with a more affordable option.

-

- BNPL (Klarna and Afterpay) and Support (Zendesk and Gorgias) are the only 2 categories with 2 players in the Top 10.

-

- Yotpo’s acquisition play has them as the category leader (#1) in Reviews + Loyalty and the #2-3 player in the SMS space.

Fast Risers

All 3 apps have emerged onto the scene with a real go-to-market presence in/after 2020 to capture meaningful (7%+) Plus market share.

-

- Rebuy – 9%

-

- Triplewhale – 7%

-

- Elevar – 7%

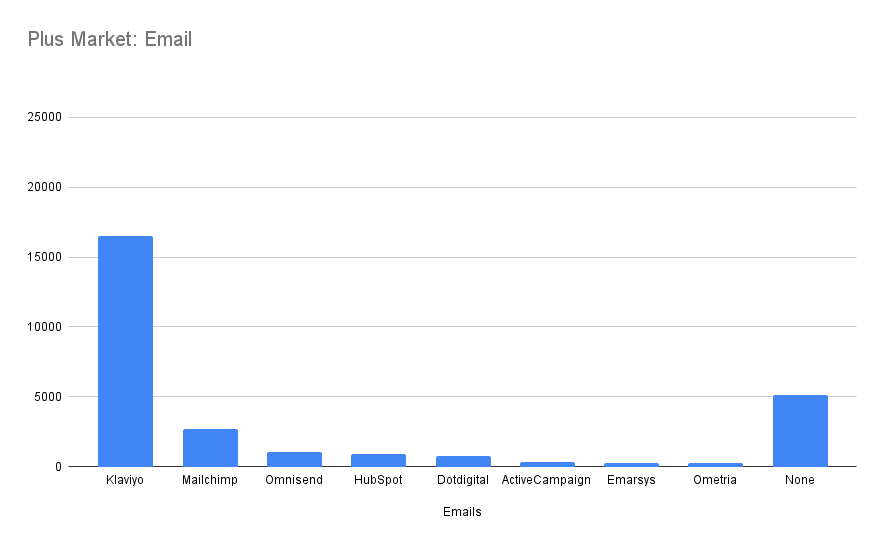

Email: 82% Market penetration across all providers

Big Picture: Email is by far the dominant 3rd party adopted in the Plus space, with the next closest category (Reviews) having almost 2x the market penetration of the next closest category, Onsite Personalization & Search (49% Plus Market share).

Player Breakdown: The email space is dominated by Klaviyo, which by itself has close to as much market as the #2 category. Interestingly the #2 player in the space is still Mailchimp with 10% of Plus stores considering they were delisted from the app store from ‘19 – ‘22. (One possible explanation for this is that the code is still installed on their site without if being actively used). Every market usually resolves into 3 main players who dominate the space. Unless 2 players can unseat Mailchimp, it looks like Omnisend is leading the pack at 4%, but it’s a close chase between Hubspot and Dotdigital with 3%.

More Context: This level of penetration is also why Klaviyo is looking to expand into other market categories (like SMS). To continue the narrative of a growth stock, they need to expand into other market categories to continue growing at a fast clip considering how much penetration they already have in email.

-

- Klaviyo: 59%

-

- Mailchimp: 10%

-

- Omnisend: 4%

-

- Hubspot: 3%

-

- Dotdigital: 3%

-

- ActiveCampaign: 1.25%

-

- Emarsys: 1%

-

- Ometria: 0.8%

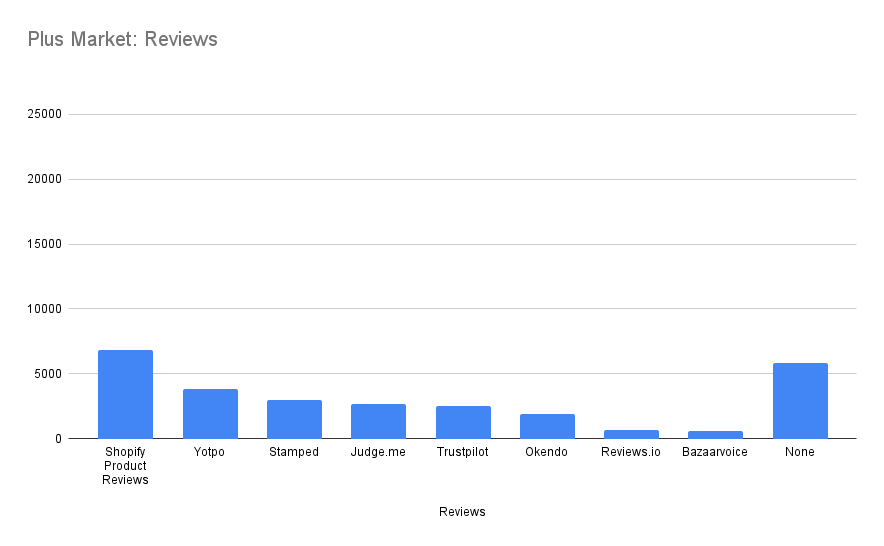

Reviews: 80% Market penetration across all providers

Big Picture: Reviews is one of the most fragmented markets in the Shopify Plus market, with 6 providers with a 7% market share each. It is the only category with many direct competitors in the Top 50 apps.

Player Breakdown: Shopify’s Native review app has a 25% Plus market share and is technically the leader in the space. Yotpo is still the 3rd party market leader with 14%, but not by much, with 3 providers (Stamped, Judge, Trustpilot), each owning 9%+ of the market, and Okendo isn’t far behind with 7%. It’s interesting to see how 1-2 player here hasn’t emerged to dominate the market as we see in most other core categories.

More Context: All of these businesses are doing well with decent market share, but none dominate a winner take all type approach that you’d expect from a SaaS company. Over a 5 year horizon, we wouldn’t be surprised if there’s consolidation in this space.

-

- Shopify Reviews*: 25%

-

- Yotpo: 14%

-

- Stamped: 11%

-

- Judge.me: 10%

-

- Trustpilot: 9%

-

- Okendo: 7%

- Loox: 5%

- Okendo: 7%

-

- Reviews.io: 2%

-

- Bazaarvoice: 2%

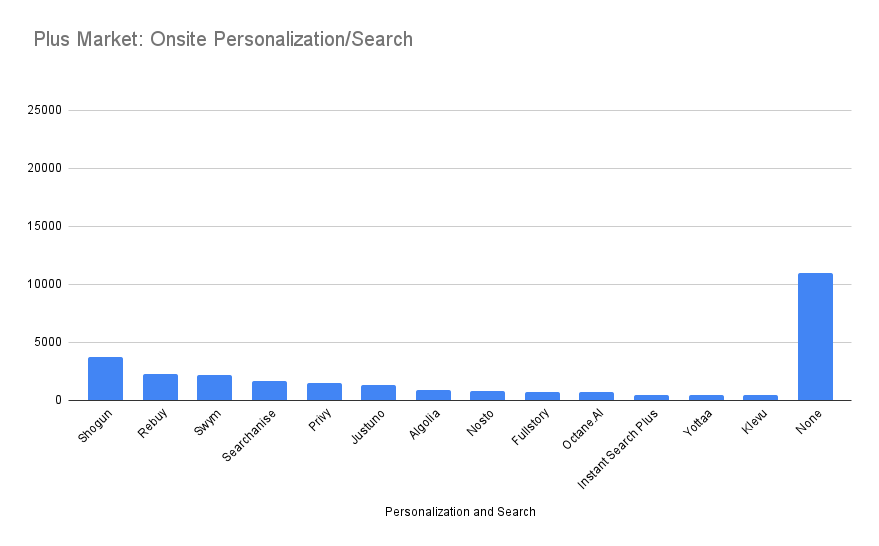

Onsite Personalization/Search 62% Market penetration across all providers

Big Picture: This section was one of the hardest to organize as every provider does something slightly different, but their offerings overlap heavily.

Player Breakdown: Shogun (page builder), Rebuy (onsite personalization), Swym (Wishlist), and Searchanise (Search) are leading their respective sections of personalization. There are many players in each space with significant room for growth left.

More Context: Not all of these players are head-to-head competitors with each other, so there might be some overlap in market share for the providers that aren’t directly competitive. I would expect some roll-ups to happen in this space, with Headless and Shopify Sections becoming a more popular trend in the Plus space and components with more brands looking for new solutions entering the space.

-

- Shogun – 13%

-

- Rebuy – 9%

-

- Swym (Wishlist+) – 8%

-

- Searchanise – 6%

-

- Privy (Attentive) – 5%

-

- Justuno – 5%

-

- Algolia: 3%

-

- Nosto: 3%

-

- Fullstory: 3%

-

- Octane AI: 2%

-

- InstantSearch Plus: 2%

-

- Yottaa: 2%

-

- Klevu: 1.4%

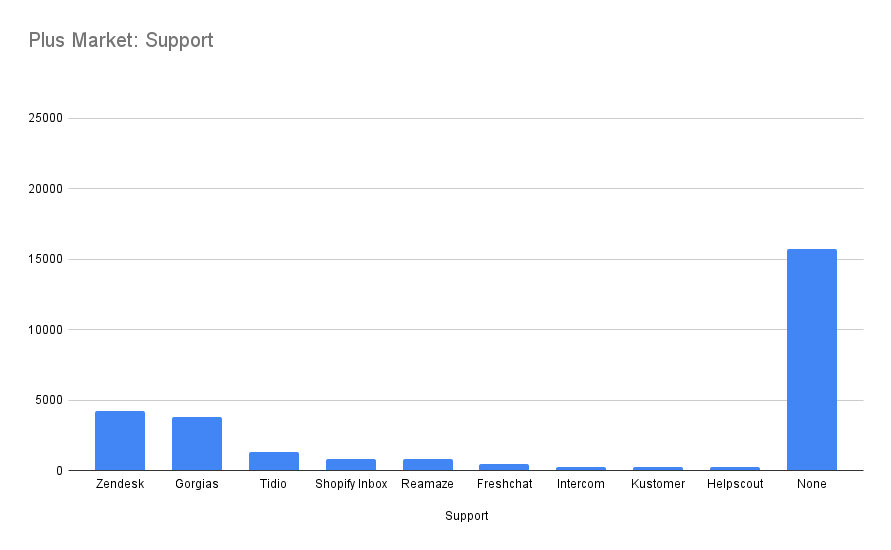

Customer Support: 48% Market penetration across all providers

Big Picture: Customer Support has a surprisingly low overall market penetration with most Plus stores (55%) not currently using a Customer Support platform. No one player is truly dominating the space, with Zendesk and Gorgias at a 1% difference from each other.

Player Breakdown: Zendesk and Gorgias have a clear lead in this market and appear to be competing for the 1-2 spot, with Zendesk as the incumbent. There currently looks to be a long tail of players looking to take the 3rd spot.

More Context: This space is surprisingly filled with incumbents for a sector with such low market share. Shopify Inbox, released in 2021, and Gorgias, founded in 2017, are the 2 youngest players in this list, with the rest of the companies being founded in 2015. ****Shopify Inbox (Shopify’s native support platform) has quickly risen to the 4th player for Plus merchants in a year which is surprising and poises them to be the 3rd player in the space.

-

- Zendesk: 15%

-

- Gorgias: 14%

-

- Tidio: 5%

-

- Shopify Inbox*: 3%

-

- Reamaze: 3%

-

- Freshchat: 2%

-

- Intercom: 1%

-

- Kustomer (Meta) : 1%

-

- Helpscout: 0.8%

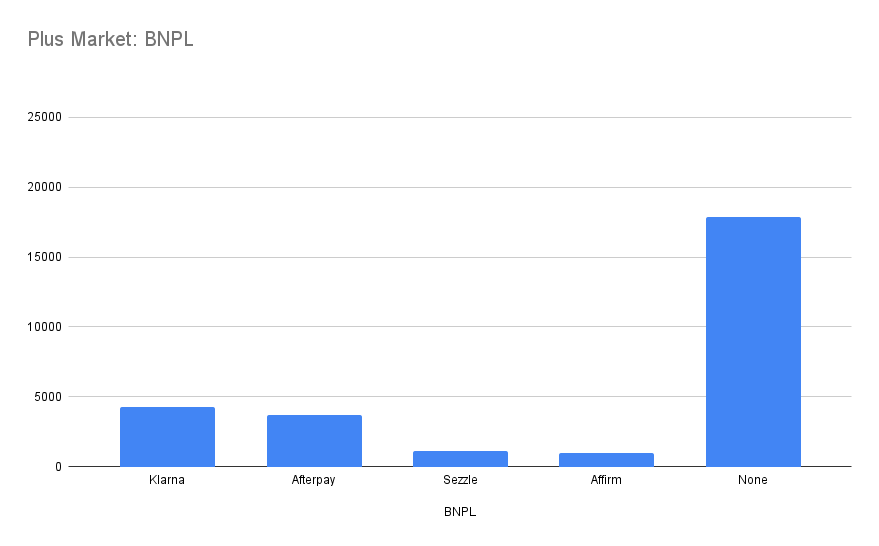

BNPL: 36% Market penetration across all BNPL providers

Big Picture: Buy Now Pay Later (BNPPL) providers took off like a rocket in the space over the last 6 years and have gone from an innovative new payment option to a 5th highest category for Plus merchants to adopt.

Player Breakdown: This space is dominated by Klarna and Afterpay (owned by Block), with Sezzle and Affirm duking it out for third in this market. That being said, there’s still a considerable amount of market share (64%) left for the taking that will either go to the top players already or a major shift

More Context: It’ll be interesting to see where this space goes over the next 3 years. Until 2022 it seemed like these providers were taking off, and nothing was going to stop them. With Millennial debt at all-time highs, we’ll have to monitor how the adoption of these trends changes with changing economic factors. The data sourcing we are using doesn’t allow us to identify how many stores have Affirm installed on them because of their integration with Shop Pay.

-

- Klarna: 15%

-

- Afterpay (Block): 13%

-

- Sezzle: 4%

-

- Affirm: 4%

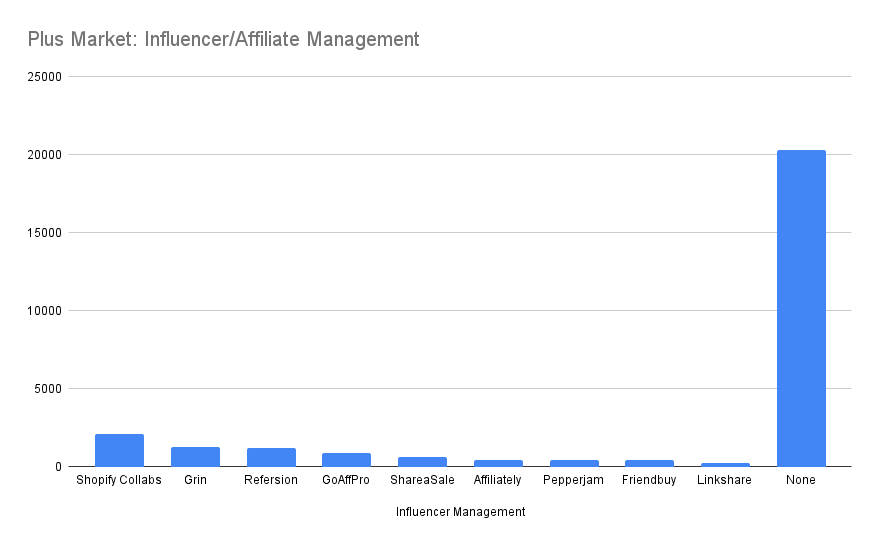

Influencer/Affiliate Management: 27% Market penetration across all providers

Big Picture: The Influencer/Affiliate Management has good penetration (27% overall) for a category that is a mix of incumbent tools (primarily on the Affiliate side) and a new fast-growing category (Influencer).

Player Breakdown: Shopify Collabs is the clear leader in the space with an 8% market share, double the top 3rd party apps Grin and Refersion at 4% each. There is a lot of competition in this space, but no one has emerged to take clear ownership of the category. Although Shopify is poised to be that player.

More Context: If I was a provider in this space, I’d be concerned about how quickly Shopify Collabs, launched in August 2022, has grown. Not all of these providers are head-to-head competitors, but they all play in the space.

-

- Shopify Collabs*: (8%)

-

- Grin: 4%

-

- Refersion: 4%

-

- GoAffPro: 3%

-

- ShareaSale: 2%

-

- Affiliately: 2%

-

- Pepperjam: 2%

-

- Friendbuy: 1.4%

-

- Linkshare: 1%

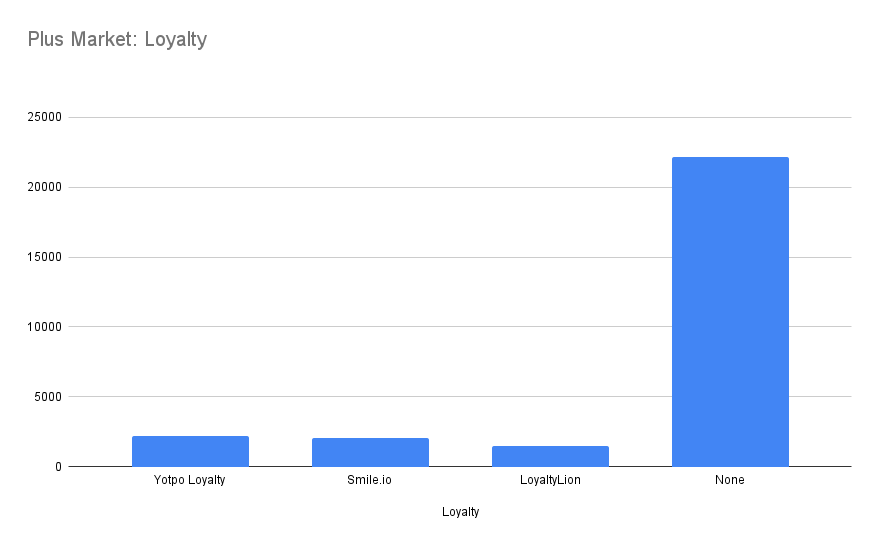

Loyalty: 20% Market penetration across all Loyalty providers

Big Picture: Interestingly, Loyalty is a core feature of traditional retail; it’s one of the least competitive categories in the Plus space, with 20% market share. Only 3 providers have significant penetration and seem to dominate the market.

Player Breakdown: Yotpo’s early acquisition strategy is working out, leading both the Reviews and Loyalty categories with Smile and LoyaltyLion close behind. We’ll have to see if another player enters the space to challenge any of these providers.

More Context: How much growth is left in the space? The youngest provider, Swell Rewards, was founded in 2015, with Smile and LoyaltyLion being around since 2012. There’s been a significant amount of time for these brands to develop and gain market share. Maybe Loyalty isn’t an everyone can use it category.

-

- Yotpo Loyalty (Swell): 8%

-

- Smile.io: 7%

-

- LoyaltyLion: 5%

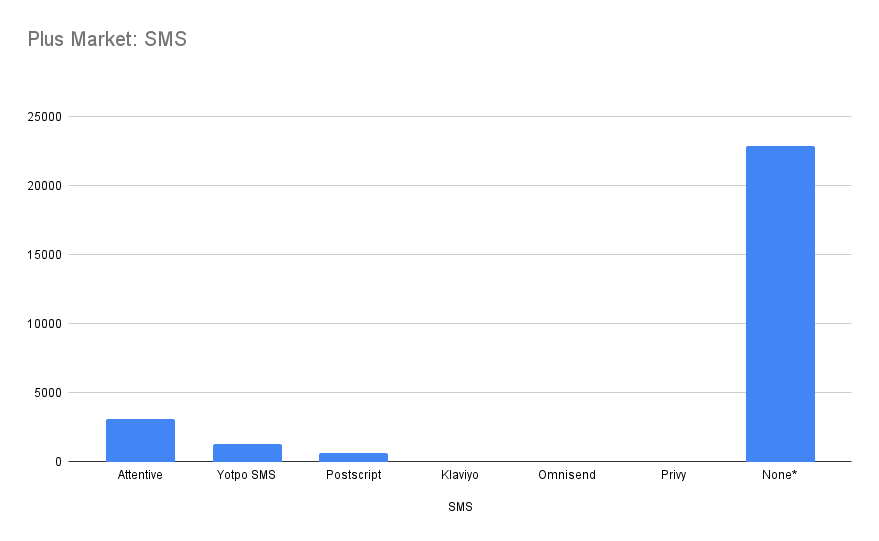

SMS – 19%** Market penetration across all providers

Big Picture: SMS most likely has deeper penetration in the space as we can’t identify how many stores have Klaviyo, Omnisend, or Privy SMS installed on their site. SMS has meaningfully taken off in the space since the major players emerged in 2018/19. We wouldn’t be surprised if the overall market penetration was closer to the BNPL or Support market penetration.

Player Breakdown: From the data we have, Attentive is the leader in the space with 11% market share and the #13 overall installed Plus app/tech. Our best estimate is to put Klaviyo somewhere in the Top 3 with Yotpo SMS in 2 or 3.

More Context: While all of these players are head to head in the SMS space, there is a likelihood that a portion of these brands is using multiple tools at once (An SMS and Email provider) so there is also some overlap in market share with the email category.

-

- Attentive (11%)

-

- Yotpo SMS (SMSBump) – (5%)

-

- Postscript – (2%)

-

- *Klaviyo, Privy and Omnisend

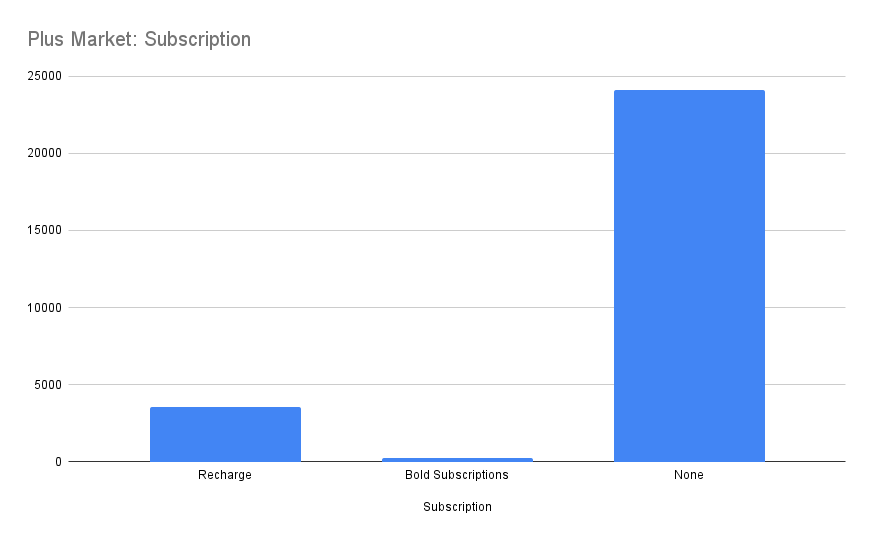

Subscription – 14% Market penetration across all providers

Big Picture: Subscription has been such a popular topic in the industry for so many years it’s surprising to see it have such a low overall market penetration of 14% overall.

Player Breakdown: Recharge dominates the space taking 13% of the 14% overall penetration in Plus stores. While there are other subscription providers, Bold Subscriptions is the other player in the space with at least a 1% Plus market share.

More Context: The interesting question that this poses: Is there a TAM limit in the Shopify space for subscription offerings? Recharge and Bold Subscriptions have both been around since 2014. Anyone in the Plus space has heard about either one of them, so why isn’t there more adoption?

-

- Recharge: 13%

-

- Bold Subscriptions: 1%

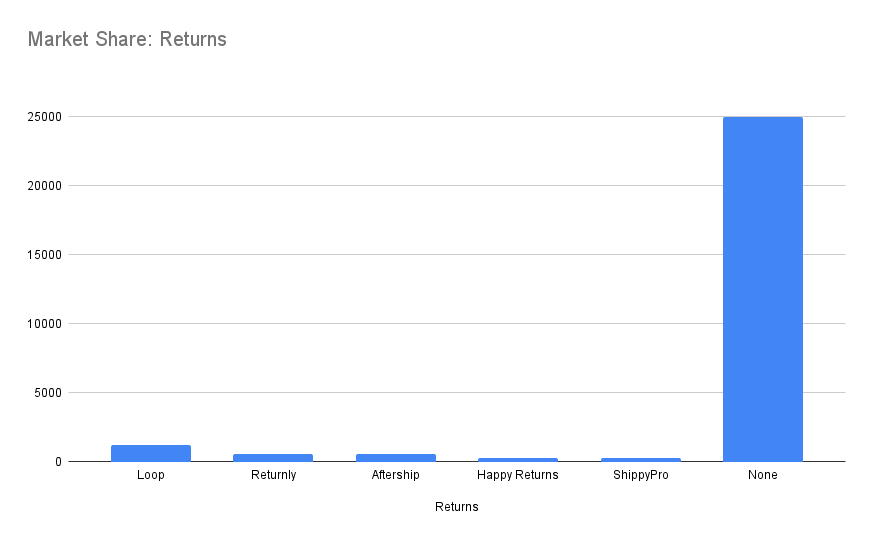

Returns – 10% Market penetration across all providers

Big Picture: Returns has one of the lowest market penetration across all core eCommerce shopping experiences in this analysis. A considerable amount of growth seems to be left for this category as no provider owns more than 5% of the category.

Player Breakdown: Loop is the leader in the category with 4% of the market share compared to the 2 next closest players (Returnly and Aftership).

More Context: Most providers in this space are focusing on the largest bracket of Shopify stores. These providers and price points appear to target the upper bound of what Plus stores can pay.

-

- Loop: 4%

-

- Returnly (Affirm): 2%

-

- Aftership: 2%

-

- Happy Returns: 1%

-

- ShippyPro: 1%

Advertising Pixels

Big Picture: No surprise here that the advertising category has the deepest penetration with 13 providers with at least 2% of Plus stores having a pixel from the provider on their site. While these aren’t considered apps/technologies we’ll cover them here. (Reminder this is number of store installed not budget spent.)

Player Breakdown: Facebook and Google dominate the space. Pinterest and Tik Tok are the next major providers with half the market share as the major players. Surprising Bing Ads rounds out the Top 5 with 22% market share 2x the next provider Snapchat. Despite Facebook’s dominant marketshare and ubiquity in the space there’s still 26% of the market that isn’t using the Facebook pixel on their site.

More Context: All of these market shares represent the number of stores that have pixels installed on their site. This data doesn’t represent the budget allocation or performance of the channel, but indicates how many brands have the pixels installed on their site.

-

- Facebook: 74%

-

- Google Ads: 61%

-

- Pinterest: 31%

-

- TikTok: 29%

-

- Bing Ads – 22%

-

- Snapchat: 11%

-

- Criteo: 9%

-

- Twitter Pixel: 5%

-

- Linkedin Insight Tag: 4%

-

- Reddit Pixel: 3%

-

- Outbrain: 2%

-

- Taboola: 2%

-

- Steelhouse: 2%

Most Popular Payment Options

Big Picture: No payment provider (payment options at checkout) has a dominant market share, but the 2 major mobile providers (Apple and Google) are the leaders in the space. Shopify makes 70% of its revenues from Merchant services (payment processing). This is an important category for them in the future.

Player Breakdown: Apple and Google lead this category, but not by much. Shop Pay is 1% behind Google, and with the investment Shopify is putting behind it, I wouldn’t be surprised if it’s competing with Apple before long. Amazon and Meta pay have such low market penetration it’d be interesting to get number on how much GMV is processed by them.

More Context: This category is incredibly important for all parties involved. How money flows through the digital economy determines how things are built and what gets investments. This area will be make or break for Shopify in the next decade. Driving more adoption of their services, including Apple and Google Pay, will be crucial as they break new GMV limits across stores. Yes, Shopify also takes a cut when customers use Apple and Google pay.

-

- Apple Pay: 66%

-

- Google Pay: 54%

-

- Shop Pay: 53%

-

- Paypal: 50%

-

- Amazon Pay: 17%

-

- Meta Pay: 9%

-

- Adyen Online Payments: 0.25%

Infrastructure

Big Picture: The set it and forget it category. This infrastructure makes your site work without you having to actively manage it. These tools are primarily free and what you’re dev team tells you to set when launching the site. Everyone should recognize these tools at this point.

Player Breakdown: What surprises most brand owners is discovering they are Cloudflare customers without really knowing it. Cloudflare is the CDN that Shopify uses for all the live photos and videos on your site. What shocks me the most is the discrepancy between stores with Google Analytics (85%) and Google Analytics Enhanced eCommerce (69%).

More Context: These tools are typically used on their free version and power other businesses. Other than Cloudflare, a paid expense that Shopify covers for their customers. While Google is primarily doing this to get brands to spend more money on their ad platforms, they also capture data en masse.

-

- Cloudflare – 96%

-

- Google Analytics – 85%

-

- Google Tag Manager – 74%

-

- Google Adsense – 69%

-

- Google Analytics Enhanced eCommerce – 68%

Conclusion

This is just a sample of the 7k+ apps in the Shopify space that service brands looking to grow through better tools. With Shopify Plus being the fastest-growing segment of Shopify there will be continued investment from the ecosystem into more tools and offerings. As we’ve seen throughout the data set and category that there’s still tons of room for more Apps and offerings to grow across all Shopify Plus categories.

Even Email which has 80%+ penetration and the largest single player Klaviyo at 59% still has 18% of the market that isn’t using one of the major tools.

There’s still plenty of opportunity for more brands to find more tailored solutions as more providers are launched/move into new spaces. Plus, Shopify will be there to push the baseline up and drive more from Apps/Tech.